Guest article by Adriano Lombardo*

Maslow meets the RealUnit

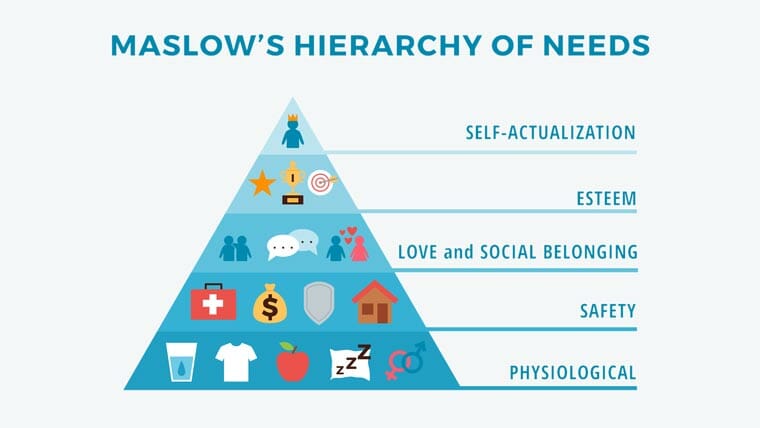

The name might sound familiar to you. In university and in the study of economics in particular, Maslow appears as a representative of humanistic psychology in almost every textbook. Perhaps you remember his famous “hierarchy of needs” pyramid. In this case, we will focus on the two lowest levels of need, as they align the best with the business case of RealUnit Schweiz AG.

How does the RealUnit utilize Maslow’s principles?

Undeniably, physiological needs (basic needs) are among the most powerful and are necessary for survival: “Someone who lacks food, security, love, and esteem would probably hunger for food more than for anything else.” (Maslow, Motivation and Personality, 1954).

These basic needs include food, water, air, sleep, physical warmth, sexuality, exercise, physical/mental health, and protection from danger.

From this, it can be deduced that industries and companies offering goods and services at this level of need provide what is essential for survival. These needs must always be met first.

RealUnit invests directly in companies such as Bell Food Group, Emmi, WWZ, The Kraft Heinz Company, Savenica, Austevoll Seafood, Ovis, Raststätte Thurau, Fundamenta Real Estate, etc. It also has stakes in CPH Chemie + Papier Holding AG, and Vetropack Holding, which are involved in the value creation around basic needs.

According to the 2022 Annual Report, RealUnit has allocated 19.9% to companies that satisfy basic needs.

Depending on how you look at it, there are certain needs that can be classified both as “first level” as well as second. Of course, the needs pyramid is to be understood as a fluid model.

What is classified as a security need?

On this level, we find safety, stability, security, protection, etc.

Let’s link these needs again with the investments of RealUnit Schweiz AG. 35.7% is allocated to physical precious metals These are stored in Switzerland, which provides an additional security layer due to the country’s largely stable legal system. We can also include here the company’s 2% stake in Holcim.

What further advances could RealUnit Schweiz AG make according to Maslow’s principles?

Placing an even greater emphasis on lower-level, existential needs could be beneficial.

Focusing even more on areas like food production (agriculture, fishing, etc.), the health industry, the housing sector and security industry, could bring RealUnit in an even closer alignment with Maslow’s ideas.

Key takeaways

RealUnit Schweiz AG is invested in various real assets and the company also holds more liquid positions.

80% of RealUnit’s total assets (incl. cash and cash equivalents) can be categorized as existential and security needs and can be considered rather crisis-resistant and value-preserving. ** **

The remaining 20% can be assigned to the top three levels according to Maslow and these positions can be regarded as more volatile.

Overall, the RealUnit can be described as a crisis-resistant, value-preserving investment according to Maslow’s pyramid.

* About Adriano Lombardo:

As a private person, business economist and vocational school teacher (general education, economics + law), the world of economics has always interested me. As part of a continuing education program, I will link economic concepts and theories, based on the fundamentals of the various framework and school curricula, with the business case of RealUnit Schweiz AG (RealUnit) in Baar. RealUnit is free to publish my content. I assume no liability for activities of third parties based on my deductions. If you are interested in making your business model available for teaching purposes, please contact me (adriano.lombardo@bbzsogr.ch). In the future, education must focus even more on practice – and vice versa. I generally prefer projects on which the students can work over a longer period of time in a subject-oriented and case-specific way and from which they can benefit as a result.

**The quality (financial statements, market positions, etc.) and competitiveness (future) of the investment positions, taking into account possible threats and opportunities (external factors), have not been examined.